- (+86) 021-60870195

- No.2555,Xiupu Road, Pudong, Shanghai

- [email protected]

No.2555,Xiupu Road, Pudong, Shanghai

(+86) 021-60870195

We Sincerely Welcome You To Contact Us Through Hotlines and Other Instant Communication Ways.

Anode material refers to the raw material that constitutes the negative electrode in the battery. At present, common anode materials include carbon anode material, tin-based anode material, lithium-containing transition metal nitride anode material, alloy anode material and nano-scale anode material. In recent years, the shipments of anode materials have grown steadily, the market share of artificial graphite has increased, and the industry concentration has increased.

Shipments

The market size of anode materials in China has increased from 148,000 tons in 2017 to 365,000 tons in 2020. In 2021, China's anode material shipments are about 720,000 tons, a year-on-year increase of about 100%. It is expected to maintain a substantial growth trend in 2022, with shipments exceeding 1.2 million tons.

Industrial structure

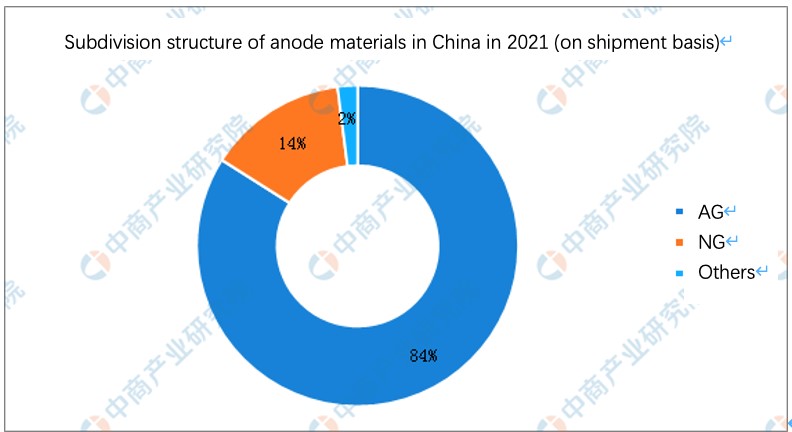

From the perspective of product shipment structure, driven by the market demand for power and energy storage, artificial graphite has better consistency and cyclicity than natural graphite, driving the proportion of artificial graphite to increase; China's major lithium battery companies are gradually turning to artificial graphite, driving The proportion of artificial graphite shipments has further increased. In 2021, the proportion of artificial graphite products will continue to increase, and the market share will rise to 84%; the proportion of natural graphite will decline, and the market share will drop to 14%.

Competitive Landscape

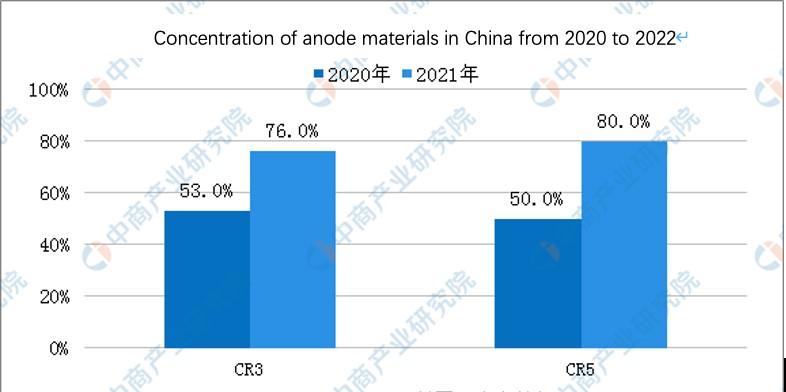

It is reported that downstream demand is strong, TOP3 companies have limited production capacity, and they’re in full production and full sales status, while other powerful companies with production capacity have sufficient orders, and the capacity utilization rate has increased, occupying part of the market share of CR3; in 2021, the anode material shipment of CR3 is around 50%, a year-on-year decline of 3 percentage, and CR6 was 80%, an increase of 4 percentage points year-on-year.

The top three in the anode material industry are basically dominated by BTR, Jiangxi Zichen and Shanghai Shanshan. The shipment of Shangtai Technology enters the top five in 2021, and the shipment of Guangdong Dongdao enters the eighth in 2021.

Copyright © 2022. Prominer (Shanghai) Mining Technology Co.,Ltd.Technical Support : Qianxing | Privacy Policy